HOW MUCH DO I NEED TO SAVE FOR RETIREMENT?

Fabian Taylor, senior associate and chartered financial planner in Nelsons’ wealth management team, works out how much money you’re likely to need in retirement based on your lifestyle and what you’ll need to save in order to achieve this goal.

It’s all too easy to put saving for your retirement to the back of your mind, especially if you have more immediate financial concerns. However, with pensions, the advice is always the earlier the better as it means you can save less each month than if you started at a later age.

In order to work out how much you need to save for retirement, you need to work out what your expenditure is likely to be. This will vary from person to person and the type of lifestyle you want in retirement.

As priorities change throughout retirement, expenditure will also alter. For instance, spending on holidays, eating out, and hobbies may be higher at the beginning of retirement and reduce as people get older, while expenditure on utility bills, health, and insurance premiums may increase.

A survey carried out by Which? on its members in April 2020 showed that the annual spending for a retired couple wanting a lifestyle to cover the essentials was a little over £17,000 per year. For a comfortable retirement, expenditure increased to £25,000 and for a luxurious retirement, expenditure was £40,000 each year.

For the essential lifestyle, expenditure covered the basics, for example groceries, housing payments, insurances, transport, utilities, health, household goods, and clothes.

A comfortable lifestyle in retirement covered all the basic areas of expenditure, as well as some luxuries such as European holidays, hobbies, and eating out, while a luxurious retirement included long-haul holidays and a new car every five years.

Expenditure for a single person in retirement was £13,000, £19,000 and £30,000 for a lifestyle covering essentials, a comfortable retirement and luxurious retirement respectively.

Sources of income in retirement

The State Pension will form the backbone of retirement income for most people. The age at which you can access your State Pension is 66 but this will rise to 67 by 2028.

For people who reached their State Pension age on or after the 6th April 2016, the maximum State Pension is currently £175.10 per week, although this is increasing to £179.60 per week from April 2021.

Assuming a couple is entitled to the maximum State Pension, this would provide more than £18,000 worth of income per year. You can obtain a State Pension forecast on the government’s website if you are unsure what amount you would get.

On top of the State Pension, you may have private or occupational pensions. There are two types: final salary (defined benefit) or money purchase (defined contribution).

Final salary pensions provide you with a regular monthly income throughout your retirement and typically provide a spouse or dependent with a pension on your death. The amount you get is based on your earnings while you were working and the length of time you were working for the company that offered the final salary pension.

Money purchase pensions invest your and your employer’s contributions. The value of your pot at retirement is based on the amount of contributions paid and the investment return.

You can take money from a money purchase pension in a variety of ways, but most people choose income drawdown or an annuity.

An annuity provides you with a guaranteed income for the rest of your life, while there is more flexibility with income drawdown as you can take as much or as little from your pot whenever you want – although this flexibility comes with increased risks.

How much will I need in my pension pot?

For a 66-year-old married couple in good health and wanting a comfortable retirement, both receiving the full State Pension, they would need additional income of just under £7,000 to reach £25,000 a year.

If an annuity is the chosen route, they would require a pension pot of £249,174 to receive the additional income on a joint life basis (paying a spouse’s pension of 50%) and increasing in line with the Retail Prices Index (RPI).

For a luxurious retirement, a pot of £799,633 would be required to generate an income of just under £22,000 on the same basis, i.e. 50% spouse’s pension and increasing by RPI.

With drawdown, your money remains invested while taking withdrawals and, therefore, can potentially benefit from investment growth.

Assuming you live to the age of 94, withdrawals increase by 2% each year to match inflation and the drawdown pot grows by an annualised rate of 3% after fees, you would need a pot of £173,000 for a comfortable retirement and £554,000 for a luxurious retirement.

| Comfortable | Luxurious | |

| Pot required for annuity | £249,174 | £799,633 |

| Pot required for drawdown | £173,000 | £554,000 |

How much will I need to save into my pension?

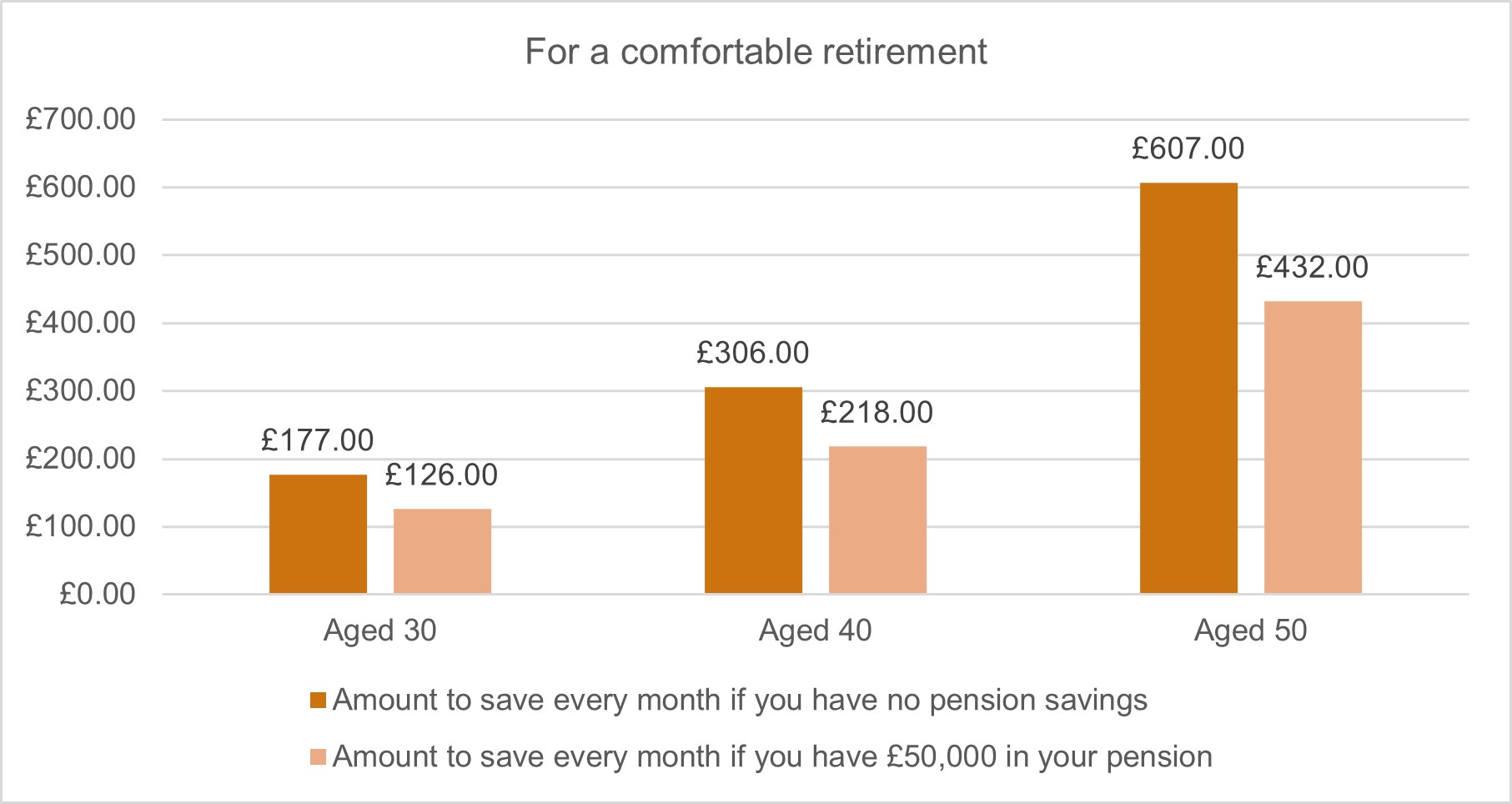

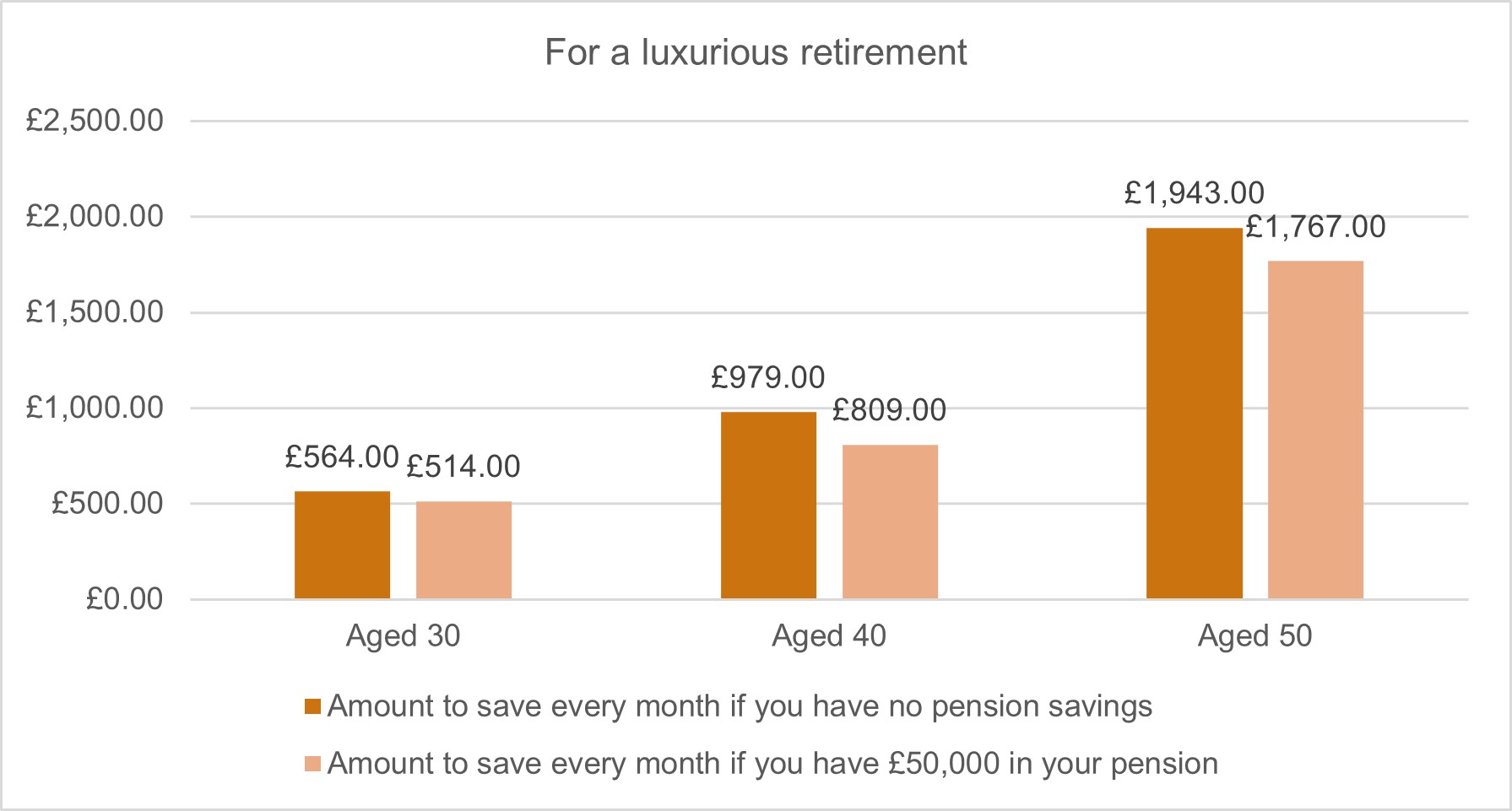

Based on the figures above, it is possible to calculate what a couple would need to save each month to achieve a comfortable or luxurious retirement.

The calculations assume an annualised 4% growth rate net of charges and covers those who are just starting out on their journey to pension savings and those who have amassed some pension funds already.

For a couple aged 30 with no pension savings, you would need to save £177 each month for a comfortable retirement or £126 per month if they already have a pension pot of £50,000.

For a couple starting to save for their retirement at age 40, they would need to put away £306 a month or £218 per month if they already have pension savings of £50,000.

At age 50, a couple would need to save £607 monthly if they had no pension savings or £432 a month if they have savings of £50,000.

The figures for a luxurious retirement are, understandably, higher starting at £564 a month for a couple aged 30 with no pension funds or £514 per month for those with amassed pension savings of £50,000.

A couple would need to save £979 a month at age 40 if they had no pension savings while this reduces to £809 monthly if they have £50,000 in pensions.

For couples aged 50, the monthly savings needed if they had no pension funds would be £1,943 or £1,767 if they had £50,000 in pensions.

While the figures may seem daunting at first glance, many people will already be saving for their retirement through a workplace pension under auto enrolment rules. In addition, your salary should rise as you get older. Nonetheless, the earlier you start saving for a pension the better, whether it be in a classic pension pot or via self managed super funds, for example.

These figures are based on a number of assumptions and everyone will have different requirements in retirement.

For more support with personal pensions and retirement planning, please visit www.nelsonslaw.co.uk/pension-planning.